How did the declining title of a video game company find itself in the middle of a war between stockbrokers and Wall Street giants? Why is this showdown panicking the stock markets? Back in 7 questions on a totally unprecedented stock market outbreak, against a background of the rise of social networks.

This is the saga of the beginning of the year on Wall Street: in a few sessions, the action of GameStop has climbed at a dazzling pace, fueled by a group of stockbrokers on a crusade against the “establishment”.

Back in 7 questions on this totally unprecedented stock market outbreak, against a backdrop of the rise of social networks.

1) What is the origin of the phenomenon?

GameStop is an American video game distribution brand based in Texas which has owned the Micro mania chain of stores since 2008. Torn down in recent years by the rise of online games, it has become a privileged target for a category of hedge funds, the “short-sellers”. The stock was the most short-sold of the entire U.S. stock market in 2020, according to S&P Global.

Only then, since the beginning of the year, GameStop has become the darling of legions of individual traders who find themselves on the Reedit forum entitled “WallStreetBets”. Its title began to take off on January 12, buoyed by changes to its board of directors with the goal of doubling digital sales.

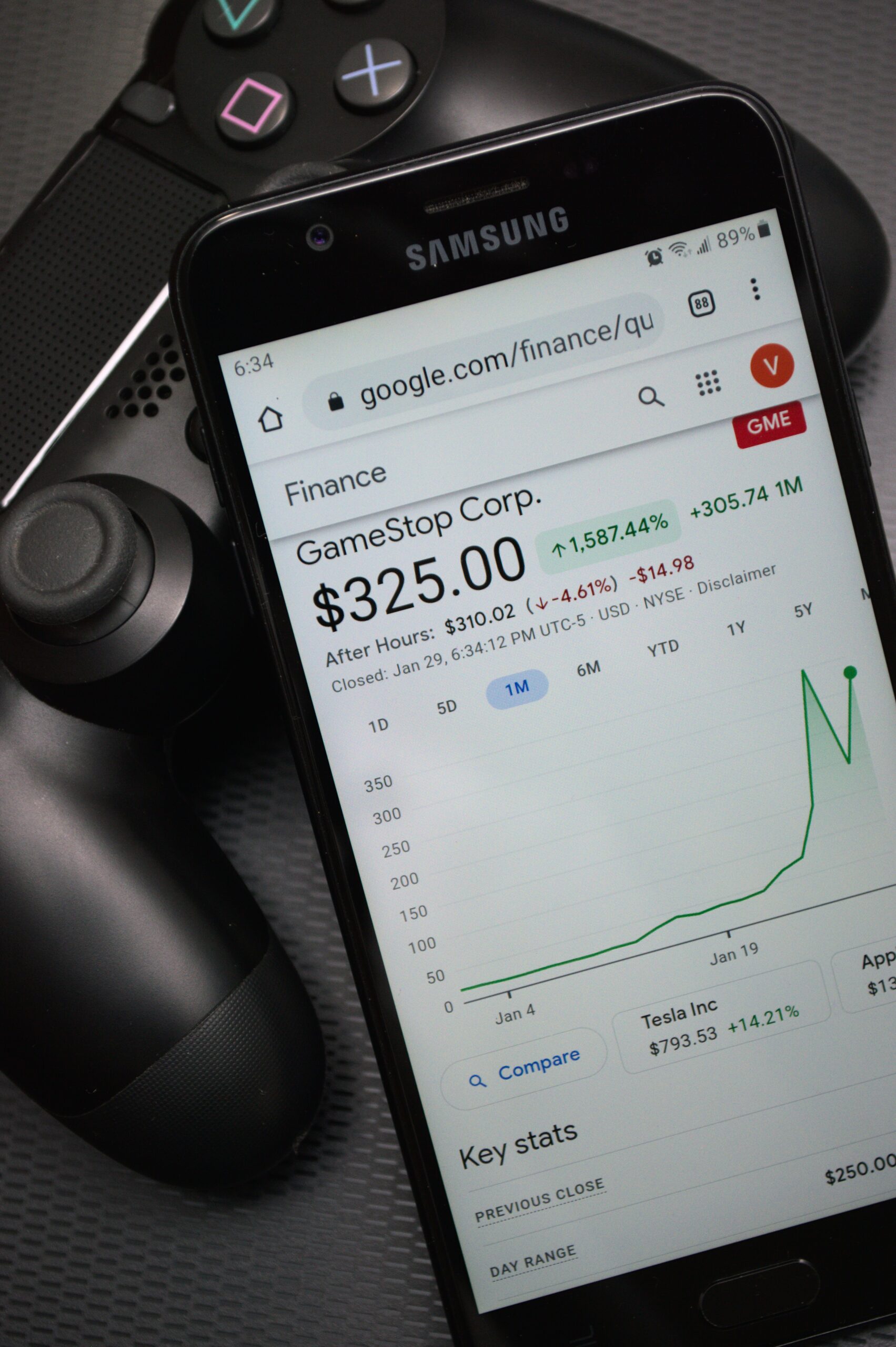

Still trading at just under $ 20, the stock price rose gradually at first, before taking off on the 25th. sent the title into space, reaching 483 dollars Thursday in session, to close again at 325 dollars Friday evening. In all, the title has taken more than 1,600% since the beginning of the year.

2) Who are the members of “WallStreetBets”?

Individuals looking for thrills? Geeks nostalgic for vintage brands? The Reedit forum, which already totaled 2.2 million members on Wednesday morning, had more than 7 million on Sunday. Behind the most eccentric pseudonyms, the members of “WallStreetBets” exchange tips and brag about their stock market gains with a lot of screenshots and memes. Their objective ? Kill hedge funds that sell securities short.

One of the initiators of this campaign, DeepF***ingValue, who hosted a YouTube channel under the pseudonym of “Roaring Kitty”, images of kittens in the key, was identified as a 34-year-old American financial adviser. He had been campaigning for GameStop since 2019, posting his earnings and saying the company was undervalued. His posts ended up attracting attention.

His last post on Saturday showed a gain of more than 4,000% on GameStop to reach a value of $46 million. When the arm wrestling with the hedge funds hardened, the messages also multiplied on the forum to incite the stockbrokers above all not to sell their shares.

3) Why are hedge funds trapped?

Hedge funds specializing in short selling have literally been caught in their own trap . Their losses have been counted in the billions of dollars since the beginning of January. On the GameStop title alone, short sellers have accumulated nearly 20 billion in losses, according to specialist S3 Partners. Hedge funds have reduced their downside bets by 8% over the past week, the firm says, but they are still far from disarmed: GameStop remains the third most targeted title by value.

It doesn’t matter to individual traders that the stock market valuations of GameStop – or others – are totally out of touch with reality. The low liquidity of these securities, the mechanisms underlying short selling and the use of tools such as derivatives allow them to have a very strong impact on the market. This strategy game, in which they turn the techniques and tools of professionals against them, has turned into a real showdown.

Individuals have identified with the people, left behind, who are revolting, while hedge funds are becoming the symbols of an establishment that takes advantage of the “system” to enrich itself ever more. Excesses are common. Steve Cohen, the boss of the hedge fund Point 72, deleted his Twitter account on Friday after being harassed on the platform. He had become a prime target for stock traders since his fund came to the rescue of Melvin Capital.

This hedge fund had to resort to an injection of 2.75 billion dollars of capital after having recorded losses of more than 50% on its portfolio in the month of January alone, according to the Dow Jones agency. Melvin Capital was one of the first to throw in the towel in the face of the revolt of the stockbrokers. Citron Research, for its part, announced Thursday that it was giving up its position on GameStop, before decreeing on Friday to end all its research activity that could encourage short selling, its main activity for twenty years. A decision that caused a stir on Wall Street: Citron Research was one of the first operators to track market fraud.

The others are waiting for the storm to pass. Carson Block, boss and founder of the hedge fund Muddy Waters, told “Les Echoes” that he had made the decision on Wednesday to significantly reduce all his non-American short positions, and to put on hold any plan to launch new sales campaigns. Discovered.

4) How is the movement internationalized?

Encouraged by this first victory, the individuals grew bolder. Short sellers then went from being market predators to prey. By coordinating on forums and social networks, traders began to target other companies that were in the sights of “short sellers”.

The AMC cinema chain, Nokia, BlackBerry, the Polish video game publisher CD Projekt and Unibail-Roams-Westfield have become the new fronts in the battle against short sellers, causing an internationalization of the phenomenon. Amateur investors have even turned to silver, a precious metal that has fueled conspiracy theories for decades.

Traders also pounced on bit coin, which soared on Friday after Elon Musk posted “#Bit coin” followed by his emoji on his Twitter profile. The price jumped 16% to exceed $38,000, before falling back to $33,000.

5) Why have trading platforms suspended operations on the most speculative securities?

The tension was such on the markets in recent days that Robinhood, the pioneer of “zero commission”, and main weapon of stockbrokers had to suspend purchases of GameStop shares and a dozen other titles on Thursday. A decision experienced as a real betrayal by the users of the online broker, who have already filed more than 18 complaints against him.

Robin hood isn’t the only platform to put a stop to speculation. Most of its competitors also have restrictions in place. Indeed, the unusual volatility of these securities prompted the American clearing house, the DTCC, to revise its capital requirements upwards. Given its customer base, Robin hood has been hit hard. The broker had to multiply by ten the regulatory capital, that is to say the sums set aside to secure its transactions on the equity markets, the company indicated in a blog post. To deal with it, the broker raised a billion dollars in emergency from its shareholders and drew on its lines of credit.

Robin hood, however, maintained a number of restrictions. About fifty titles are concerned. On GameStop, its users can purchase a maximum of one action and up to five options. The European IG Group, for its part, announced on Saturday the suspension of transactions on GameStop and AMC, another target of American stockbrokers.

6) What does the regulator do?

The phenomenon ended up attracting attention. New US Treasury Secretary Janet Yelena said on Wednesday she was “monitoring the situation”. The policeman of the American markets, the SEC, for its part indicated on Friday “monitoring and evaluating closely the extreme volatility of the price of certain actions”.

Following the cessation of trading on GameStop and other securities decided by certain brokerage platforms on Thursday, the SEC will examine whether these measures may have “disadvantaged investors or unfairly limited their ability to invest in certain securities” . The SEC warned traders against illegal maneuvers to drive up stock prices and said it was working to “identify and prosecute potential wrongdoing”.

After the outcry aroused by the temporary suspension of exchanges on Thursday, vilified by American elected officials of all stripes as well as by very many Internet users, the platform announced “a limited resumption of purchases of these titles” from Friday.

7) Fad or systemic risk?

Brought together by social networks, the hordes of retail investors have shown that they have the power to change the rules of the game on Wall Street. Forgotten, the economic fundamentals, from the level of profits to the dynamics of growth, on which professional investors rely.

Analysts are also confuse by the sometimes political motivations of these traders, with some willing to lose thousands of dollars just to join in. Is it still possible to invest in such an environment? “ This question is far from being anecdotal and without risk for financial stability. Indeed, this perception could encourage many investors to abandon equity investments. How to invest your long-term savings if the valuation no longer depends on a rational model of business valuation, but on discussions on social networks? » emphasizes Laurel BGC.